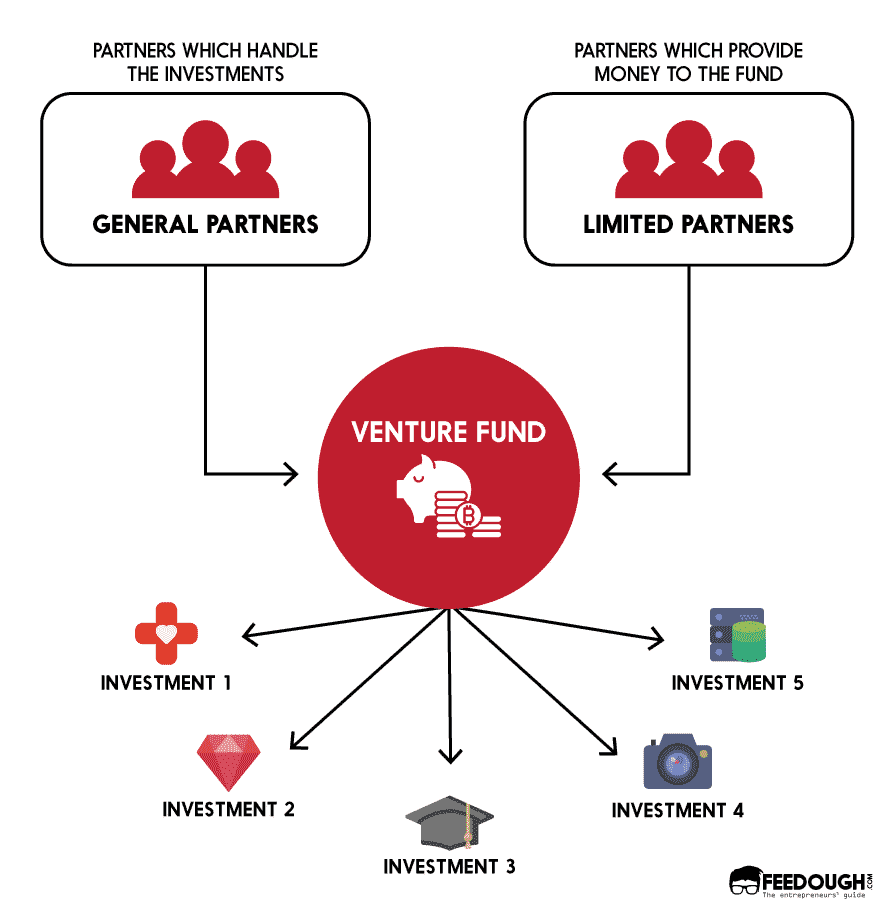

In 2019, Sequoia made more new seed-stage investments than Series A deals. Following the June 2023 announcement to make the three entities independent, beginning 2024, the ventures would no longer share investors or profits. and Europe, another on India and Southeast Asia, and a third on China. Sequoia is an umbrella brand for three different venture entities: one focused on the U.S. The firm has also distinguished itself from other top venture capital firms by diversifying its investments and not just focusing on U.S. The firm has been often recognized for its strong track record of early investments. Sequoia specializes in seed stage, early stage, and growth stage investments in private technology companies, including those in the clean tech, consumer internet, crypto, financial services, healthcare, mobile, and robotics sectors. Its limited partners have primarily been university endowments, charitable foundations, and other large institutions. Investors, referred to as limited partners, contribute money to a fund that the firm's general partners then invest in business ventures. Sequoia Capital is structured as a limited liability company. and Europe unit would retain the Sequoia name. Following the separation, expected to complete by March 2024, the Chinese business led by Neil Shen would be called HongShan ("sequoia" in Mandarin) and the Indian and Southeast Asia arm would be named Peak XV Partners. In June 2023, Sequoia announced plans to break up into three entities citing complications running a decentralized global investment business in the middle of geopolitical tensions. įollowing the collapse of Silicon Valley Bank in March 2023, the Federal Deposit Insurance Corporation had backstopped Sequoia's $1 billion in deposits in the bank. In March 2022, The Information reported that Sequoia Capital China was raising an $8 billion fund to invest in Chinese tech companies. and European business that would allow it to remain involved with companies after their public market debuts. In October 2021, Sequoia announced it would implement a new fund structure for its U.S. In March 2020, Sequoia announced it would hire Luciana Lixandru as its first partner based in Europe. In 2019, it was the most active VC fund company in India. In 2016, Sequoia hired Jess Lee, making her the first female investing partner in the United States in the firm's history. Jim Goetz led Sequoia’s US business from 2012 until 2017, when he was succeeded by Roelof Botha. In 2012, Moritz took a step back from the day-to-day operations of the firm. In 2005, Sequoia Capital China was established, later followed by Sequoia Capital India. In 1999, Sequoia established a dedicated investment fund for Israeli startups. Partners Doug Leone and Michael Moritz assumed leadership of the firm in 1996. In 1978, Sequoia became one of the first investors in Apple. Sequoia formed its first venture capital fund in 1974, and was an early investor in Atari the next year. Sequoia was founded by Don Valentine in 1972 in Menlo Park, California, at a time when the state’s venture capital industry was just beginning to develop. Notable successful investments made by the firm include Apple, Cisco, Google, Youtube, Instagram, LinkedIn, PayPal, Reddit, Tumblr, WhatsApp, and Zoom. As of 2022, the firm had approximately US$85 billion in assets under management. Sequoia Capital is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors.

0 kommentar(er)

0 kommentar(er)